Key home requirement: The law helps you to exclude the cash in on your taxable money provided that the house was your Main residence (you lived in it for two of your five years leading up into the sale, and you simply didn't presently assert an exclusion on Yet another household in the last two years).

A top rated real estate agent could also offer a comparative industry analysis of your own home’s benefit, or make it easier to plan a pre-listing appraisal of your property for more in-depth information and facts.

Waiting until eventually you've got lived in your house for 2 years might not be possible. But when it has been a lot less than a year given that you got it, waiting around a handful of far more months just before selling could cut your tax Monthly bill considerably.

As well as the list goes on. If any from the situations seem common, you're in the correct area and HomeGo can be one of the best tips on how to sell your house quick in Dallas.

Capital gains taxes: In case you receive a profit on the sale, capital gains taxes are more likely to be the greatest price you might face when selling your own home so shortly after getting it. You’d fare greater on this front if the house was your Principal residence for at least 24 consecutive months: “Capital gains tax will probably be owed Should you have not [still] lived within your Main home for 2 years,” claims Taylor.

We use Most important sources to help our work. Bankrate’s authors, reporters and editors are issue-make a difference industry experts who carefully reality-Examine editorial material to be certain the information you’re examining is accurate, well timed and appropriate.

Selling your own home after possessing it for a number of years, or perhaps under just one year, isnt a great situation. There are many of components stacked from you: capital gains taxes, closing costs, confined market place appreciation, and unfavorable purchaser notion.

There is absolutely no formal or official penalty for selling a house after only one year, as there best site could be for, say, withdrawing money from an IRA early. Some home loans might carry a prepayment penalty for closing out the property finance loan so early, but that’s somewhat uncommon. Having said that, in case you sell before click here to read you decide to’ve been in a house for at least two years, you may well be penalized in other techniques: For one, any financial gain you understand is more more likely to be issue to money gains tax.

Should you be in a better tax bracket and count on to show A significant earnings, the distinction between selling in 6 months vs. selling after a single year can be tens of thousands of bucks.

Should you be selling your house after a year or significantly less and generate profits within the sale, you'll have to pay cash obtain taxes on that financial gain. Exactly how much Individuals taxes will Price depends on how much time you owned the house, your cash flow, submitting standing, any exemptions, as well as other aspects.

A realtor can help you develop a marketing and advertising plan to sell your own home for top greenback — capitalizing on any property appreciation and in the end maintaining additional of one's really hard-acquired equity as part of your pocket. Obtain a no cost household valuation report from an agent near you!

As a company that provides dollars for houses, dealing with us indicates you'll get a fair money give you can trust. Once Find Out More we invest in houses we make our greatest supply The 1st time, each time!

You'll find further needs to qualify for the funds gains exclusion, aka the Part 121 exclusion. Here are a few of the main points about qualifying to the exemption:

Generally, you may get paid again Those people expenses in property equity after some time, but if you are selling your property after only a year, you won't have constructed up ample equity to deal with the losses.

Tony Danza Then & Now!

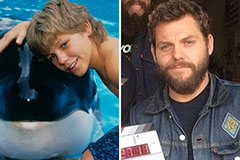

Tony Danza Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!